Defining and implementing actionable business plans to achieve strategic goals that highlight the group’s vision.

Strategic Planning is often viewed as a slow, painful and frustrating exercise considering the excessive energy required throughout the organization, the missed and obsolete short- and mid- term targets and the lack of flexibility to efficiently re-adjust the businesses’ roadmaps.

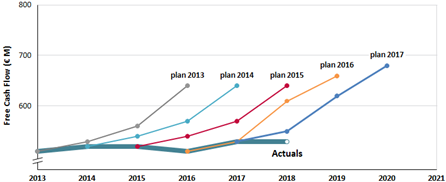

- Missed (and overly optimistic) mid-term targets are often blamed on unanticipated events or one-off events as Business units tend to focus on short term results due to incentive schemes

- Conducting real-time what-if scenarios at central level is excessively time-consuming and slow when processes depend solely on a bottom-up business planning approach

- Corporate is often not adequately armed to update and adjust its mid-term plan to both unanticipated changes in market environment and the group’s latest rolling forecast

- Corporate-subsidiary dialogue and controlling on targets is costly in both time and resources

Companies tend to build optimistic business plans but repeatedly miss mid-term targets (years > n+1) as they 1) remain overly focused on the short term, 2) fail to conduct postmortem analysis on underachieved goals and 3) often lack efficient tools to challenge the robustness of business unit forecasts.

Strategic plans tend to be overly focused on short term targets

Across its Corporate Finance practice, designed specifically around the strategic management cycle, YKems addresses strategic planning recurring concerns.

- facilitate strategic arbitrages and scenario building at corporate level

- foster dialogue and target negotiation between corporate and business units

- improve communication with shareholders and financial markets.

YKems’ Corporate Finance practice has been designed around the strategic management cycle to assist strategy and finance executives in their key activities (portfolio management, strategic planning and capex allocation)

Strategic Management Cycle

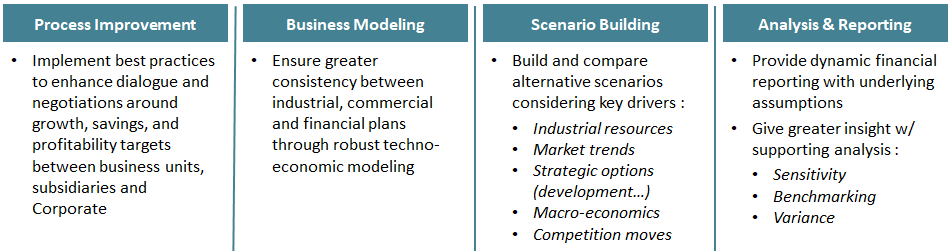

YKems advises companies in streamlining their strategic planning processes and implementing exclusive and efficient tools to support the negotiation of subsidiaries’ strategic plans and financing needs, the commitment of the subsidiaries on specific value creation targets, and the definition of growth strategy scenarios and financing options.

Key added value

Known for its expertise in financial modeling and its solid strategic and operational background, YKems provides advanced and pragmatic solutions to:

- Reinforce the credibility and consistency of business unit plans across departments (sales, industrial, financing) with a techno-economic modeling approach

- Provide fast answers to the board’s what-if scenario requests, such as the impact of cross-activity or macroeconomic variations on the group’s consolidated accounts

- facilitate strategic arbitrage and trade-offs considering timing/sizing aspects of investment options and capital allocation

- build alternatives scenarios around business-specific value drivers, development options and recent market environment changes

- create a solid basis for growth scenarios assessment and communication with financial markets

Main principles of a forecasting model